Quick Answer for Central Pennsylvania Homeowners

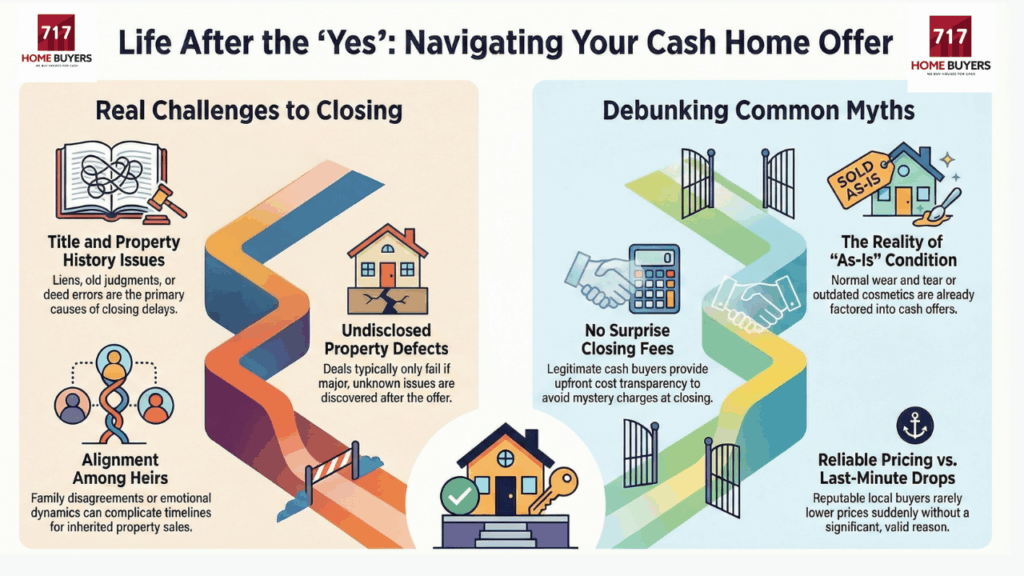

After you accept a cash offer, the only things that usually cause real problems are title issues, undisclosed property problems, and decision-maker conflicts (especially with inherited homes). Most cosmetic condition issues do not matter because they are already accounted for in an as-is cash offer. This is NOT the right choice if you are not ready to cooperate with the title company paperwork or you have unresolved family or ownership disputes that you are unwilling to address.

Who This Advice Is For

- Central PA homeowners who accepted (or are about to accept) an as-is cash offer and want to know what can derail closing

- Sellers in Lancaster, York, Harrisburg, Lebanon, Reading, or Lititz who are worried about liens, unpaid taxes, or old judgments

- Heirs selling an inherited property where multiple family members must sign

- Homeowners who want a clear timeline and want to avoid last-minute surprises

- Sellers who value certainty and simplicity more than listing, showings, and repairs

When This Is NOT the Right Choice

- If you are not comfortable providing basic documents needed for title transfer (ID, payoff info, estate paperwork when applicable)

- If there is an active dispute about ownership or an heir refuses to cooperate and you are not willing to resolve it

- If you want to maximize price and you have time for listing, repairs, showings, and buyer financing contingencies

- If you are unwilling to disclose known major issues that materially affect value or safety

- If you cannot meet a reasonable closing timeline set by the title company due to travel, access, or communication limitations

How to Decide What to Do

- Start with ownership: If the deed, estate, or heir paperwork is unclear, expect extra steps before closing.

- Assume title will be checked: If you suspect liens, judgments, or unpaid taxes, plan for a title search and potential payoff/clearance.

- Match your timeline to reality: If you need a fast close, choose a process that can handle title and paperwork quickly with a local title company.

- Protect yourself from “price-drop games”: If a buyer can’t explain the numbers and process in writing, do not sign anything.

- Keep control with questions: A calm, transparent buyer should be willing to explain what happens between “yes” and closing day.

| What can go wrong? | How common? | What usually fixes it |

|---|---|---|

| Title issues (liens, judgments, taxes, deed errors) | Common | Title search, payoffs, releases, corrected paperwork through a reputable title company |

| Buyer backs out | Less common with legitimate local buyers | Clear disclosures, written terms, and a buyer who can explain the reason (title, new discovery, decision-maker conflict) |

| Inherited home disagreements (multiple heirs) | Common in probate/estate situations | Confirm who must sign, gather estate documents early, keep timelines realistic |

| Cosmetic condition (outdated, worn, clutter) | Usually not a problem | As-is pricing already accounts for it |

| Surprise fees at closing | Should be rare in legitimate deals | Upfront written terms and a standard closing process with a recognized title company |

Why This Works for Central PA Homeowners

In Central Pennsylvania, most “cash deal” stress comes from uncertainty, not the offer itself. The cleanest closings happen when the seller understands that a cash sale still requires a title search, clear ownership, and standard closing paperwork. If something slows the process down, it is usually tied to the property’s history (liens, old judgments, unpaid taxes, deed mistakes) rather than the fact that the buyer is paying cash.

If you want to understand the basic flow ahead of time, these two pages are helpful references: how we buy houses in Pennsylvania and our home selling FAQs. If you are dealing with an estate or inherited property, this resource can help you think through next steps: what to know about probate in real estate and what to do with an inherited home.

For homeowners who want an objective comparison of paths, these explainers are useful: FSBO vs selling to a professional home-buying company and cash sale vs auction in Pennsylvania.

When you want authoritative, non-company resources to understand risk and paperwork, start here: Pennsylvania’s Unified Judicial System portal for court-related records and processes (pacourts.us), and the Federal Trade Commission’s consumer guidance on avoiding scams (consumer.ftc.gov). For tax-related questions that sometimes come up in title work, the Pennsylvania Department of Revenue is a reliable starting point (revenue.pa.gov).

Watch the Podcast Episode

Full Podcast Transcript

What can actually go wrong after you accept a cash offer?

Brian: Welcome back to the Central PA Real Estate Podcast. I’m Brian.

Chris: And I’m Chris. And today we’re talking about something that almost every homeowner thinks about — but very few people actually ask out loud.

Brian: Yeah, today’s question is: what can actually go wrong after I accept a cash offer?

Chris: Because once someone says “yes,” that’s usually when the anxiety kicks in.

Brian: Exactly. Up until that point, it’s curiosity. After that, it becomes, “Okay… what did I just do?”

Chris: We hear this all the time from homeowners across Lancaster, York, Harrisburg — really all over Central PA.

Brian: They’ll say something like, “This sounds straightforward, but what’s the catch?”

Brian: Or, “I’ve heard stories where deals fall apart.”

Chris: And those stories aren’t made up. Some deals do fall apart. But what matters is why, how often, and what’s actually within your control.

Brian: So today we’re not here to sell anything. We’re just going to walk through the real things that can go wrong — and what usually doesn’t.

Title issues are the biggest surprise

Brian: Let’s start with the biggest category: title issues.

Chris: This is the number one thing people don’t realize. Liens, old judgments, unpaid taxes, or even mistakes in past deeds can slow things down.

Brian: And to be clear — this isn’t a cash-buyer problem. This is a property history problem.

Chris: Right. Whether you sell to an agent buyer or a cash buyer, title still has to be clean enough to transfer ownership.

Brian: The difference is that experienced local buyers expect this and know how to work through it.

Can the buyer back out?

Chris: This is probably the most direct fear people have.

Brian: And the honest answer is: yes, a buyer can back out — but why they back out matters.

Chris: Most legitimate cash buyers aren’t backing out just because they changed their mind.

Brian: When deals fall apart, it’s usually because something new shows up.

Brian: A major undisclosed issue.

Brian: A title problem that can’t be resolved.

Brian: Or sometimes heirs or decision-makers who aren’t aligned.

Chris: What’s not common is a reputable buyer dragging things out or suddenly lowering the price at the last minute without a real reason.

Inherited properties can get complicated

Brian: Inherited properties are another big area where complications can pop up.

Chris: Especially when there are multiple heirs.

Brian: We’ve seen situations where everyone agrees in principle — until paperwork starts.

Chris: Then emotions, old family dynamics, or misunderstandings come up.

Brian: That doesn’t mean a cash sale is a bad idea. It just means timelines need to be realistic.

What usually is NOT a problem

Chris: This part is important. There are a lot of things people assume will be problems — that usually aren’t.

Brian: For example, normal wear and tear.

Chris: Or cosmetic issues. Or the house being outdated.

Brian: Those things are typically already accounted for in an as-is cash offer.

Chris: Another misconception is that the process is full of surprise fees.

Brian: In a legitimate cash sale, costs are usually discussed upfront. There shouldn’t be mystery charges popping up at closing.

Chris: This surprises people: most legitimate cash deals do close.

Brian: Especially when the buyer is local, the seller understands the process, and everyone is honest upfront.

Chris: Problems tend to come from rushed decisions with companies that don’t know the local market or don’t explain things clearly.

How to avoid issues after accepting an offer

Brian: If you’re thinking about accepting a cash offer, here are a few simple things that help avoid issues.

Chris: Ask questions. There are no bad ones.

Brian: Understand the timeline — and what could realistically slow it down.

Chris: And make sure you’re working with someone who’s okay explaining when a cash sale might not be the best fit.

Brian: That’s usually a good sign you’re dealing with someone legitimate.

Chris: One thing we always remind people: accepting an offer doesn’t mean you lose control overnight.

Brian: You still have the right to understand what’s happening, why it’s happening, and what your options are.

Chris: A good process should feel calmer over time — not more stressful.

No pressure next step

Brian: If you’re in Central Pennsylvania and you’re just trying to understand your options, you don’t have to decide anything today.

Chris: You can call us at 717-321-SOLD just to talk through your situation, ask questions, or even confirm whether a cash sale makes sense for you.

Brian: There’s no obligation. Sometimes the most helpful outcome is just clarity.

Chris: And if this episode helped, we’ll be back with more straight-talk conversations about selling a house without pressure.

Frequently Asked Questions

What is the most common reason a cash sale gets delayed after acceptance?

The most common reason is a title issue such as a lien, an old judgment, unpaid property taxes, or an error in a prior deed. These delays are not unique to cash buyers; they can affect any type of sale. A reputable title company typically identifies the issue early and coordinates the steps needed to clear it.

Can a cash buyer back out after I accept the offer?

Yes, a buyer can back out, but reputable buyers typically do so only when something material changes. The most common triggers are an undisclosed major issue, a title problem that cannot be resolved, or a decision-maker conflict such as heirs who do not agree. A last-minute price change without a clear, documented reason is a red flag.

Do I need to fix anything if I accepted an as-is cash offer?

In most cases, no. Normal wear, cosmetic updates, and an outdated interior are typically already reflected in an as-is cash offer. The only time the conversation changes is when a major undisclosed issue appears that materially affects safety or value.

Why do inherited house sales fall apart after an offer is accepted?

Inherited sales usually run into problems when multiple heirs must sign and not everyone stays aligned once paperwork begins. Emotions, misunderstandings, and delays in gathering estate documents can also slow closing. The simplest prevention is confirming early who has authority to sign and what documents the title company will require.

Are surprise fees normal in a legitimate cash sale?

Surprise fees should be uncommon when the process is legitimate and explained upfront. Closing costs and any agreed deductions should be disclosed clearly before closing day. If a buyer cannot explain fees in writing or introduces new charges late, pause and get clarity from the title company.

How can I reduce my risk after I accept a cash offer?

Ask direct questions about timeline, title, and the exact steps between acceptance and closing. Share known issues honestly so nothing “new” appears later. Choose a local buyer who closes through a reputable title company and is willing to explain when a cash sale may not be the best fit.

Talk With a Local Central PA Home Buyer

If you want clarity on what happens between “yes” and closing day, we’ll talk it through without pressure.

Call 717-321-SOLD (717-321-7653) or visit 717HomeBuyers.com. You can also learn more about how our local process works in Pennsylvania, and see feedback from other sellers here: read our Google reviews.

Author: Austin Glanzer | Last Updated: February 6, 2026